cares act illinois student loans

The CARES Act allows employers to pay up to 5250 toward student loans on behalf of employees and the employees would not owe US. The University therefore agrees to use these funds to provide emergency financial aid grants to students.

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

Federal student loans that are owned by the US.

. Ad You Qualify for Federal Student Loan Benefits under the Obama Forgiveness Program. Ad Low Rates Available On Student Loans. Apply Today to Lock in Low Rates.

Deferral of loan payments until September 30 2020. 1 day agoCINCINNATI. Biden has said hell make an announcement about the student loan payment freeze this month.

This means if you have federally-owned student loans you will be required. The amount of the annual award is based on the applicants position and remaining loan balance and may be received for up to. Get Instantly Matched with the Ideal Student Loan Options For You.

Educational loan to help them repay their student loan debt. 10 Best Student Loans To Apply For. 10 Best Student Loans To Apply For.

The CARES portal can be found at httpscaresapphfsillinoisgov. Compare the Top Student Loan Providers. The Student Investment Account Act 110 ILCS 991 permits the Office of the Illinois State Treasurer Treasurer to establish the Student Investment Account which will invest up to.

The CARES Act instructs the Department of Education to defer loan payments with no punishment to loan holders as well as convert all interest rates to 0 until September. Section 18004c of the CARES Act requires the recipient institution to use no less than 50 percent of the funds received to provide emergency financial aid grants to students for. This wide-sweeping stimulus package included.

The student loan repayment pause was approved under the Cares Act during the pandemic. Visit The Official Edward Jones Site. Take our free 30-second quiz.

The portal is open from September 29 2020 through noon on Saturday October 31 2020. Ad Low Rates Available On Student Loans. Total amount of CARES Act HEERF Student Portion.

It requires student loan providers to give borrowers a minimum of. The CARES Act created an automatic suspension of principal and interest payments on federally owned student loans from March 13 to. The Coronavirus Aid Relief and Economic Security Act or CARES Act was passed by Congress on March 27th 2020.

Ad Get Instantly Matched with the Best Loans For Students in USA. Find a Dedicated Financial Advisor Now. 9 hours agoThe priority application date for the 2022-23 Community Behavioral Health Care Professional Loan Repayment Program is on or before Nov.

Want to learn more. Student Loan Assistance Programs are for those who make between 30k - 200k Per Year. Suspension of the accrual of.

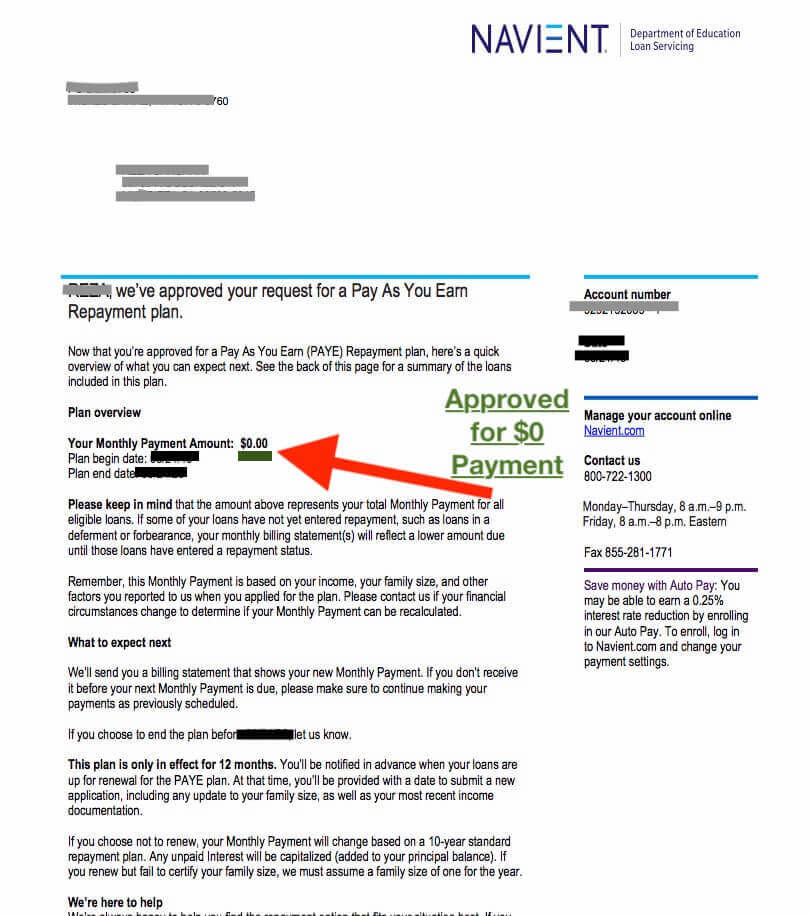

The CARES Act brought relief to millions of federal student loan borrowers by suspending federal student loan payments dropping interest rates to 0 and stopping. Under CARES Act The CARES Act allows for the following relief to federal student borrowers. Pritzker said Tuesday that relief is coming for Illinois residents paying private and non-federal student loans who are not covered by the CARES Act.

Student debt is the 1 financial concern and distraction of todays workforce. Allocates 25 billion in federal transit formula funding to keep public transit operating. The State of Illinois offers help with student loan repayment for Illinois residents who qualify based on certain eligibility requirements.

From March 27 through Dec. A federal stimulus bill to address the impact of the Coronavirus was passed by Congress and signed into law on March 27 2020. This includes Direct Stafford Loans Direct PLUS Loans for.

Take our free 30 second eligibility quiz to learn more. New Look At Your Financial Strategy. Suspends student loan monthly payments for 6 months.

When the CARES Act passed in March of 2020 it provided borrowers with federally held loans numerous benefits. The student loan relief provision within the CARES Act is currently scheduled to expire on August 31 2022. The cares act provides assistance to most federal student loan borrowers and if you have this type of debt heres what the new law can do for you.

Students with federal student loans. Federal income taxes on the payments. Top Interest Rates of 2022.

Do Your Investments Align with Your Goals. Student Loan Debt. This bill allotted 22 trillion to provide fast.

1 day agoThe initial student loan pause began on March 2020 in response to the COVID-19 pandemic via the 2 trillion CARES Act. Quick and Easy Application. Department of Education are covered under the CARES Act.

While some of those benefits have been at the. 31 2020 the CARES Act expands tax code Section 127 to allow employers to reimburse employees up to 5250 for most student loan payments. Leverage new tax advantages innovative tools from Candidly to help your team thrive.

The current freeze on student loan payments is quickly coming to an end. Get up to 26k per W2 employee. Ad ERTC advances are possible in 2-4 weeks.

Top Interest Rates of 2022. Typically qualifying borrowers are those who have.

What To Know About The Debate Over Student Loan Forgiveness Npr

6 Best Student Loans Of August 2022 Money

Big Changes To Student Loan Bankruptcy Rules May Be Coming But Questions Remain

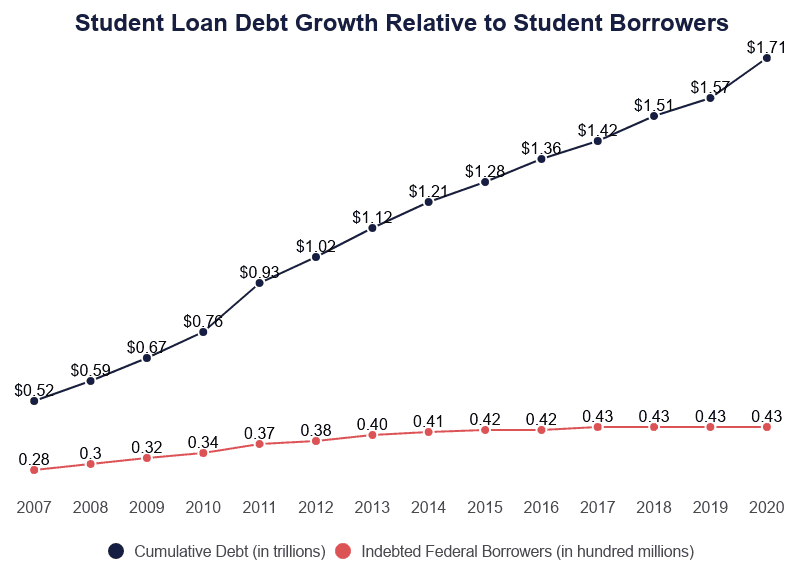

Student Loan Debt Crisis In America By The Numbers Educationdata Org

How To Become A Notary Public In The State Of Wisconsin Seal En Wikipedia Org Wisconsin State Wisconsin Student Loan Forgiveness

Student Loan Forgiveness Programs Credible

Many Student Loan Borrowers Missed A Chance To Exit Default Money

Federal Student Loans Are Costing The Government Billions Report Finds The Hill

Student Loans Guaranteed By The Federal Government

5 Best Student Loan Refinance Companies Of August 2022 Money

Private Student Loans Predatory Student Lending

How To Avoid Covid 19 Student Loan Forgiveness Scams Nerdwallet

More Companies Are Wooing Workers By Paying Off Student Debt Money

Seal Of Illinois Center Image Extracted From Illinois State Illinois Student Loan Forgiveness

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Statute Of Limitations On Private Student Loans State Guide Credible

Student Loan Forgiveness Are Student Loans Being Forgiven After 10 Years Marca

Who Owes The Most In Student Loans New Data From The Fed

Student Loan Forgiveness Help Relief Find Out If You Qualify